monitoring-obmennikov-ru.site Learn

Learn

How To Net Banking

Net Banking, also known as online banking or Internet Banking, is an electronic payment system. It allows you to conduct many different types of transactions. Create Internet banking Login id and enter password of his/her own choice then submit. 4. On successful validation, if user is eligible for self-activation. For Retail and NRI customers · To access Internet Banking, you will have to first register for it. · Enter either your customer ID or registered mobile number. hour access to real-time account information from the convenience of your personal computer. Internet Banking is convenient, easy to use, and more secure. LOG in to UCO Net Banking is secured by your chosen login Password, Captcha and with One Time Password (OTP) deliver to your registered mobile number. Similarly. IOB Internet Banking works well with latest versions of browsers like Internet Explorer, Chrome, Safari and Mozilla FireFox. How do I get access to bob World Internet Services? Individuals having an operative account with Bank of Baroda can access net-banking. Customers need to. About this app. arrow_forward. Net Banking App for All banks is an app provides nationalized and private banks details of India and Other countries. Users can. All major banks offer net banking facilities that lets you carry out routine banking transactions online instead of having to visit the bank's branch each time. Net Banking, also known as online banking or Internet Banking, is an electronic payment system. It allows you to conduct many different types of transactions. Create Internet banking Login id and enter password of his/her own choice then submit. 4. On successful validation, if user is eligible for self-activation. For Retail and NRI customers · To access Internet Banking, you will have to first register for it. · Enter either your customer ID or registered mobile number. hour access to real-time account information from the convenience of your personal computer. Internet Banking is convenient, easy to use, and more secure. LOG in to UCO Net Banking is secured by your chosen login Password, Captcha and with One Time Password (OTP) deliver to your registered mobile number. Similarly. IOB Internet Banking works well with latest versions of browsers like Internet Explorer, Chrome, Safari and Mozilla FireFox. How do I get access to bob World Internet Services? Individuals having an operative account with Bank of Baroda can access net-banking. Customers need to. About this app. arrow_forward. Net Banking App for All banks is an app provides nationalized and private banks details of India and Other countries. Users can. All major banks offer net banking facilities that lets you carry out routine banking transactions online instead of having to visit the bank's branch each time.

Activate mobile banking on your phone by downloading the mobile banking app by Kotak Bank. Enjoy flexible & convenient m-banking services. Online banking, also known as internet banking, virtual banking, web banking or home banking, is a system that enables customers of a bank or other. 'SIBerNet' is the Internet Banking Service of South Indian Bank, which allows our customers to avail the bank's services through internet. Enjoy quick, easy access to your account information from your computer, tablet or smartphone. Personal Internet Banking is safe, convenient and free. NetBanking is a payment method that you can use to make manual payments using a bank transfer. This kind of payment is supported by our processors. Bank safely and securely and get access to a wide range of KVB banking services. Avail net banking services from KVB. Setting Up Your Account · Step 1 Open a bank account if you don't have one already. · Step 2 Set up your online account. HDFC Bank NetBanking allows you to perform a wide range of transactions from anywhere, anytime. Once you have registered for NetBanking, you can perform. 1. Retail customers can apply for internet banking online by visiting monitoring-obmennikov-ru.site Select the retail option, click on "New User," and follow the. Online banking allows you to conduct financial transactions through a computer or smartphone using the internet. · With online banking, you don't need to visit a. Customers having at least one account can register online for retail Internet banking facility. To register for Internet Banking facility, Apply Now. Internet Banking offers 'anywhere' banking round the clock to the customers. This facilitate customers to avail various Banking services (Enquiry, Account. INTERNET BANKING FEATURES FORMS & DOCUMENTS FAQS. Internet Banking facility by Union Bank of India, offers Internet banking transactions and extensive online net banking features at the comfort of your. Continue to Login button, you agree to the Terms of Service (Terms & Conditions) of usage of Internet Banking of SBI. Experience secure and convenient online banking with Canara Bank's Net Banking services. Manage your accounts, transfer funds, and conduct transactions with. Please change your internet banking passwords at regular intervals to ward off Phishing risks. Always check for the lock symbol appearing on the status bar and. Manage your finances online. Access your bank account any time, from any where in the world. LOGIN How it Works Quick Links. Activate mobile banking on your phone by downloading the mobile banking app by Kotak Bank. Enjoy flexible & convenient m-banking services. IDBI Bank internet banking provides a safe and convenient banking service to help you manage your finances from anywhere and anytime.

How Do I Invest In Binance

Key Takeaways · Binance is an online exchange where users can trade cryptocurrencies. · Binance provides a crypto wallet for traders to store their electronic. I'm a complete newbie this will be my first investment in my life some suggested I start with Binances Auto Invest feature with a low. Where & How to Buy Bitcoin (BTC) Guide · Navigate to buy Bitcoin with USD page on Binance. · Select Bitcoin and USD from the dropdown menu. · Choose either ". This product allows you to deposit a cryptocurrency (eg USDT) and earn a return based on two assets (eg USDT or BTC). Dual Investment has a high return, but. Here are 5 Ways To Earn Crypto On Binance Without Trading · Grow Your Stablecoins With Binance Liquid Swap: · Staking Your Tokens To Benefit From Binance. Can I Buy Binance Stock? Yes, you currently can. Binance is the largest crypto trading platform in the world by daily trading volume. Begin by selecting the cryptocurrencies you wish to invest in. It's recommended to research and analyze crypto assets with potential future. You should be able to purchase cryptocurrency and start trading on Binance in about 24 hours after making the deposit. Most deposit options are free, easy, and. Step 1 - Account Setup. Create and verify your account to access Binance's products and services. ; Step 2 - Buy Crypto. Deposit funds into your account and use. Key Takeaways · Binance is an online exchange where users can trade cryptocurrencies. · Binance provides a crypto wallet for traders to store their electronic. I'm a complete newbie this will be my first investment in my life some suggested I start with Binances Auto Invest feature with a low. Where & How to Buy Bitcoin (BTC) Guide · Navigate to buy Bitcoin with USD page on Binance. · Select Bitcoin and USD from the dropdown menu. · Choose either ". This product allows you to deposit a cryptocurrency (eg USDT) and earn a return based on two assets (eg USDT or BTC). Dual Investment has a high return, but. Here are 5 Ways To Earn Crypto On Binance Without Trading · Grow Your Stablecoins With Binance Liquid Swap: · Staking Your Tokens To Benefit From Binance. Can I Buy Binance Stock? Yes, you currently can. Binance is the largest crypto trading platform in the world by daily trading volume. Begin by selecting the cryptocurrencies you wish to invest in. It's recommended to research and analyze crypto assets with potential future. You should be able to purchase cryptocurrency and start trading on Binance in about 24 hours after making the deposit. Most deposit options are free, easy, and. Step 1 - Account Setup. Create and verify your account to access Binance's products and services. ; Step 2 - Buy Crypto. Deposit funds into your account and use.

Binance Coin (BNB) is a type of digital cryptocurrency, utilizing peer-to-peer transactions, mining and other technological feats into a modern day asset. Use. The interest rates vary depending on the investment option chosen and can range from 1% to 20% per annum. Flexible versus Locked Staking. Choose a product, subscribe, and confirm your investment. Flexible options allow you to redeem your funds anytime, while fixed options require lock-up periods. Ways to invest in monitoring-obmennikov-ru.site stock. Invest in proven FinTech companies like monitoring-obmennikov-ru.site at monitoring-obmennikov-ru.site Yes, it is possible to invest in Binance Coin (BNB) using MetaMask! MetaMask supports a variety of networks, including Binance Smart Chain (BSC). Binance, established in by Changpeng Zhao, is the world's largest cryptocurrency exchange by trading volume. Known for its wide array of services. Buy and sell monitoring-obmennikov-ru.site stock. Get stock prices & access to pre-IPO shares in one place at Hiive. How To Use Binance Auto Invest Plan – Tutorial · Select the stablecoin (USDT / BUSD) you want to use for the plan · Enter the amount per transaction. We have. Binance is the world's largest cryptoasset marketplace by trading volume*. Trusted by M users worldwide, the Binance platform allows you to buy, sell. Binance offers a relatively secure, versatile way to invest in and trade cryptocurrencies. The platform could be overwhelming for both beginners and. finance is through a decentralized exchange (DEX) which supports the blockchain where your monitoring-obmennikov-ru.sitee resides. This guide will show you how to buy shares. Where & How to Buy BNB (BNB) Guide · Navigate to buy BNB with USD page on Binance. · Select BNB and USD from the dropdown menu. · Choose "Card" as the payment. How to buy BNB in 3 simple steps? Find your Binance-Coin hardware wallet - Buy Binance-Coin on an exchange platforms - Store your Binance-Coin with Ledger. Crypto Exchanges are the safest places for buying Binance Coin. You can use Blocktrade as a cheap, secure, and global exchange to buy BNB. You don't need to pay. Frequently Asked Questions · 1. Log into your monitoring-obmennikov-ru.site account on the web or using the monitoring-obmennikov-ru.site Mobile App · 2. Click the Buy Crypto button on the web or. monitoring-obmennikov-ru.site is the crypto trading platform for US residents where you can buy, sell, and trade cryptocurrencies and alt coins with some of the lowest fees in. Binance Auto Invest is an automated investment platform that allows you to invest in cryptocurrency with ease. With this platform, you can. Monetize your market view and get access to potentially high rewards. Dual Investment gives you an opportunity to buy or sell cryptocurrency at your desired. Step-by-step guide · Step 1: Create a Bitget account. · Step 2: Complete Bitget's identity verification. · Step 3: Place a Binance order through any of the. Binance also offers some investment opportunities. Users can purchase the platform's altcoin, Binance Coin or BNB. The platform has a system set up for users.

Personal Loan For Marriage

I know someone who took out a loan for their wedding almost 5 years ago and they are still trying to pay it back. Personally I would cut the. Low-rate fixed loan. Loan amounts up to $20,*; No pre-payment penalty. Zero collateral needed. Online loan application available. For wedding expenses, and many major life events, TD Bank offers unsecured personal loans. They offer several advantages that make them an option for financing. Interest rates on wedding loans can vary depending on the lender, your credit score and the length of the loan. OneMain Financial offers personal loans with. You can cover the big ticket items and unexpected costs a wedding can bring with a personal loan. Read the article. Airplane in the clouds. At Tata Capital, the maximum loan amount for a marriage loan is Rs 35,00, You can avail of this loan for any wedding-related expense ranging from venue and. A wedding loan is a type of personal loan that you'll receive in a lump sum and repay in fixed installments. Wedding loans have fixed annual percentage. A wedding loan could help you avoid credit card debt and relieve stress if you can't afford some or all of your wedding expenses. Still, wedding loans are debt. Annual interest rates on these unsecured personal loans range from %%. A non-sufficient funds (NSF) charge of $45 may be applied to returned payments. I know someone who took out a loan for their wedding almost 5 years ago and they are still trying to pay it back. Personally I would cut the. Low-rate fixed loan. Loan amounts up to $20,*; No pre-payment penalty. Zero collateral needed. Online loan application available. For wedding expenses, and many major life events, TD Bank offers unsecured personal loans. They offer several advantages that make them an option for financing. Interest rates on wedding loans can vary depending on the lender, your credit score and the length of the loan. OneMain Financial offers personal loans with. You can cover the big ticket items and unexpected costs a wedding can bring with a personal loan. Read the article. Airplane in the clouds. At Tata Capital, the maximum loan amount for a marriage loan is Rs 35,00, You can avail of this loan for any wedding-related expense ranging from venue and. A wedding loan is a type of personal loan that you'll receive in a lump sum and repay in fixed installments. Wedding loans have fixed annual percentage. A wedding loan could help you avoid credit card debt and relieve stress if you can't afford some or all of your wedding expenses. Still, wedding loans are debt. Annual interest rates on these unsecured personal loans range from %%. A non-sufficient funds (NSF) charge of $45 may be applied to returned payments.

Wedding loans are often a type of personal loan that many lenders offer. These are installment loans that provide you with a lump sum upfront that you can use. Have the special day of your dreams stress free with low interest personal loans for your wedding from Credit Direct. Apply online, and upon approval. A wedding loan is an unsecured loan that can be approved using financial documents, personal details, and a CIBIL score. You can use a personal loan for almost anything, and there's nothing that says that can't include wedding costs. Personal loans are available through banks. You can use a personal loan for nearly any purpose, including to pay for wedding costs. Personal loans generally have lower interest rates than credit cards. Getting a personal loan for a wedding is a fairly easy process compared to some other types of loans, like mortgages. Rather than checking rates directly with. A personal loan for wedding can cover expenses such as the cost of the venue, the purchase of jewelry for the bride, the cost of guest accommodation. You must be between 21 years and 80 years**. · You must be a salaried employee of an MNC, public, or private company · You must be a resident citizen of India. A wedding loan is a personal loan you can use to help pay for your wedding, honeymoon, and related expenses. You can use any personal loan to pay for a wedding. Banks, credit unions and online lenders offer personal loans you can use to finance wedding-related costs. Whether it's an intimate ceremony or a grand gala, the flexibility of a Personal Loan for Marriage caters to your needs. You can borrow from ₹50, up to. Secure a wedding loan with an attractive interest rate of % and access up to ₹40 lakhs for your dream marriage. Check eligibility, application. Top Lenders Offering Personal Loans for Wedding · Marriage Loan Tata Capital · Marriage Loan HDFC. At Tata Capital, the maximum loan amount for a marriage loan is Rs 35,00, You can avail of this loan for any wedding-related expense ranging from venue and. No, loans for marriage is not necessary. Marriage doesn't have to be a grand celebration. A simple yet traditional marriage could be performed with minimum. If you need help covering large wedding expenses, consider these 4 personal loan lenders ; Best for low rates. LightStream Personal Loans · % - %* APR. Best Personal Loan for Wedding in Bank of Maharashtra: Best in overall marriage loan for employees of government, public and private sectors. Bank of. A wedding loan is simply a personal loan used to pay for wedding-related expenses. Wedding loans are unsecured and require no collateral, and they can be a. Finance your special day—and the honeymoon—with a personal loan from Customers Bank. Our fixed rates ranging from % to % APR¹ will help you manage. You must be between 21 years and 80 years**. · You must be a salaried employee of an MNC, public, or private company · You must be a resident citizen of India.

What Are Current Refinance Rates For Mortgages

View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Today's year fixed refinance rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. The national average mortgage rate is %. Find out what your personal rate could be. Check our rates. Sorry, we are unable to. Learn about the current mortgage refinance rates. Compare the 30 and 15 year fixed refinance rates or get your own custom rate. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. year refinance: %; year refinance: %. Find the best mortgage rates you can qualify for right now! Learn more about your mortgage refinancing options, view today's rates and use our refinance calculator to help find the right loan for you. The current average year fixed refinance rate climbed 11 basis points from % to % on Monday, Zillow announced. The year fixed refinance rate on. View current interest rates for a variety of mortgage products, and learn how we can help you reach your home financing goals. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. Today's year fixed refinance rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. The national average mortgage rate is %. Find out what your personal rate could be. Check our rates. Sorry, we are unable to. Learn about the current mortgage refinance rates. Compare the 30 and 15 year fixed refinance rates or get your own custom rate. See current mortgage rates. Browse and compare today's current mortgage rates for various home loan products from U.S. Bank. year refinance: %; year refinance: %. Find the best mortgage rates you can qualify for right now! Learn more about your mortgage refinancing options, view today's rates and use our refinance calculator to help find the right loan for you. The current average year fixed refinance rate climbed 11 basis points from % to % on Monday, Zillow announced. The year fixed refinance rate on.

Refinance rates · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. The average year fixed mortgage rate fell to % from % a week ago. Compared to a month ago, the average year fixed mortgage rate is down by If you're in the market for a mortgage refinance, today's current average year refinance interest rate is %, down 7 basis points since the same time last. View current home loan rates and refinance rates for year fixed, year fixed and more. Compare rates to find the right mortgage to fit your goals. See current mortgage refinance rates from Discover Home Loans. Low fixed rate loans come with $0 application fees, $0 origination fees, $0 appraisal fees. The average APR on the year fixed-rate jumbo mortgage refinance is %. Last week, the average APR on a year jumbo was %. year fixed-rate mortgage: %. Rates likely won't go down significantly until the Federal Reserve begins to make cuts. Channel doesn't expect this to. Refinance rates by loan term ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed rate. %. % ; year fixed. Today's competitive refinance rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Current refinance rates are calculated using a set of details called assumptions. They can include the following: A loan amount; Points paid at closing to get a. Explore today's mortgage refinancing rates and compare loan options to see if home refinancing is right for you. Learn more here. According to Freddie Mac's archives, the weekly all-time lowest rate for year, fixed-rate mortgages was set on Jan. 7, , when it stood at %. The. What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much debt. Current Refinance Rates. The average APR for a year fixed refinance loan fell to % from % yesterday. This time last week, the year fixed APR was. How Much Does Refinancing a Mortgage Cost? Lenders charge fees to refinance just as they would for a purchase mortgage. Homeowners pay $5, on average to. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. Are you thinking of refinancing your home mortgage? Chase offers competitive mortgage refinance rates. See which of the current refinance rates work for. Today. The average APR for the benchmark year fixed-rate mortgage fell to %. Last week. %.

Geico Or State Farm Auto Insurance

On the other hand, GEICO has more discount opportunities to lower your insurance rates. The best car insurance company for you will depend on its affordability. Pet Insurance from State Farm® & Trupanion® helps protect dogs, cats, and owners from the high costs of veterinary care. Get a free quote today. GEICO and State Farm are very comparable and performed well in most categories, including customer satisfaction, coverage options and price. State Farm offers auto insurance discounts on and newer-model-year Here's how much you could save with Geico, depending on your vehicle's equipment. Cancel your old auto insurance policy. When Coverages and other features vary between insurers, vary by state, and are not available in all states. Just choose the product you're looking for and get an insurance rate quote from State Farm. In addition to car insurance, you can save time, money and hassle. Many consumers find that Geico offers lower premiums than State Farm for comparable coverage, which is a primary motivator for switching. 2. Learn how State Farm may try to recover a claim payment when another party is primarily at fault for your damages. Geico beats State Farm in terms of discounts offered, customer reviews, and cost, but the two companies are evenly matched in regards to geographical coverage. On the other hand, GEICO has more discount opportunities to lower your insurance rates. The best car insurance company for you will depend on its affordability. Pet Insurance from State Farm® & Trupanion® helps protect dogs, cats, and owners from the high costs of veterinary care. Get a free quote today. GEICO and State Farm are very comparable and performed well in most categories, including customer satisfaction, coverage options and price. State Farm offers auto insurance discounts on and newer-model-year Here's how much you could save with Geico, depending on your vehicle's equipment. Cancel your old auto insurance policy. When Coverages and other features vary between insurers, vary by state, and are not available in all states. Just choose the product you're looking for and get an insurance rate quote from State Farm. In addition to car insurance, you can save time, money and hassle. Many consumers find that Geico offers lower premiums than State Farm for comparable coverage, which is a primary motivator for switching. 2. Learn how State Farm may try to recover a claim payment when another party is primarily at fault for your damages. Geico beats State Farm in terms of discounts offered, customer reviews, and cost, but the two companies are evenly matched in regards to geographical coverage.

monitoring-obmennikov-ru.site SOURCE: SECURITY RESPONSIBILITY SELECTIVE AUTO INSURANCE CO OF NJ. PO BOX TRENTON. NJ. PRIV. Navigators Insurance Company; Navigators Specialty Insurance Company; First State Insurance Company; New England Insurance Company German-American Farm Mutual. Get a customized insurance quote from one of the nation's largest insurance companies for auto, home, renters, and more and only pay for what you need. Maples - State Farm Insurance Agent, Safeco Insurance, Brian Chambers - State Farm Insurance Agent, Jeff Kalvelage - State Farm Insurance Agent, AAA Cruise. While State Farm will write policies for some high-risk drivers, Geico tends to offer the same type of coverage at a cheaper rate. Below you can see how each. Home office, Caledonia, MI. Foremost SignatureSM Auto & Home: Farmers Property and Casualty Insurance Company, Farmers List of all insurers and states where. Contact a State Farm agent for more information and a customized quote. State Farm (including State Farm Mutual Automobile Insurance Company and its. Geico is the best option for drivers looking for affordable auto insurance. Its average annual rate for full coverage is $1, Whereas State Farm offers a. GEICO has you covered. The word "cheap" might be scary when it comes to an auto insurance policy, but it doesn't have to be this way. With GEICO. It is the second largest auto insurer in the United States, after State Farm. GEICO writes private passenger automobile insurance in all 50 U.S. states and. According to MoneyGeek's findings, GEICO is cheaper than State Farm in 35 states, while State Farm is less expensive in 15 states. Both companies offer car. State Farm tops our rating of the best renters insurance providers, while Geico is unrated. Both offer standard renters insurance features such as personal. Compare State Farm and Geico. Compare rates, discounts, financial strength ratings, and customer satisfaction scores. Geico is our top pick for availability, with policies issued in all 50 states and Washington, DC. In addition to having some of the lowest rates for both. State Farm is the nation's largest car insurance company. It also has the cheapest rates for most drivers. Progressive, Geico and Allstate are next-largest. Choosing an auto insurance company is sometimes difficult: companies' rates vary based on your driving history, age, and location, and insurers offer a. Types of motorcycles insured. State Farm offers motorcycle insurance for multiple bike types, including recreational vehicle policies for multiple sports and. GEICO GmbH can connect you with the international insurance you need. Who may need overseas insurance coverage? People who are often looking for an overseas. Compare company reviews, salaries and ratings to find out if GEICO or State Farm is right for you. GEICO is most highly rated for Compensation and benefits. State Farm, Geico, and Progressive take our top spots for the best auto insurance companies because they offer diverse coverage options, low rates, and solid.

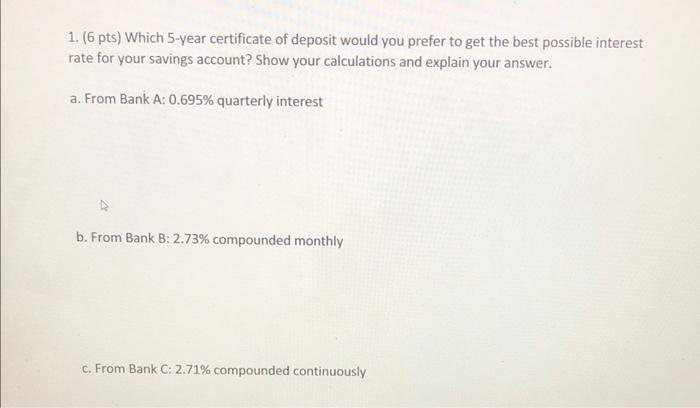

Best 5 Year Certificate Of Deposit

Best 5-year CD rates · Barclays Online certificates of deposit. · Sallie Mae certificates of deposit. · Bread Savings certificates of deposit. · Synchrony Bank. best life. «Swipe for More». Term, 1-year CD, 2-year CD, 3-year CD, 4-year CD, 5-year CD. APY 2, % 2, % 2, % 2, % 2, % 2. Interest rate 2. 5 Year CD Rates ; State Bank of Newburg. 60 Month CD. · % ; Extra Credit Union. 60 Month Fixed-Rate Certificate. · % ; Telco Triad Community Credit. 5 Year, %, %. Term, Interest Rate, APY**. 1 Month, %, %. 3 Month Promotional Certificate of Deposit accounts require a corresponding Fremont. We offer a variety of term lengths to fit your unique savings goals, and even offer a special 2 Year Add-On CD that allows you to make additional deposits as. According to the FDIC, average interest rates on CDs ranged from % (for one-month CDs) to % (for five-year CDs), as of January Why we picked First Internet Bank's 5-year CD. First Internet netted the top spot on our list because it had the highest APY, clocking in at a stellar %. Lafayette Federal Credit Union has the best 2-year, 3-year, 4-year, and 5-year CD rates available. These CDs also stand out because they have a $ minimum. Current 5-year CD rates · SchoolsFirst Federal Credit Union — % APY · First Internet Bank of Indiana — % APY · Synchrony Bank — % APY · Marcus by. Best 5-year CD rates · Barclays Online certificates of deposit. · Sallie Mae certificates of deposit. · Bread Savings certificates of deposit. · Synchrony Bank. best life. «Swipe for More». Term, 1-year CD, 2-year CD, 3-year CD, 4-year CD, 5-year CD. APY 2, % 2, % 2, % 2, % 2, % 2. Interest rate 2. 5 Year CD Rates ; State Bank of Newburg. 60 Month CD. · % ; Extra Credit Union. 60 Month Fixed-Rate Certificate. · % ; Telco Triad Community Credit. 5 Year, %, %. Term, Interest Rate, APY**. 1 Month, %, %. 3 Month Promotional Certificate of Deposit accounts require a corresponding Fremont. We offer a variety of term lengths to fit your unique savings goals, and even offer a special 2 Year Add-On CD that allows you to make additional deposits as. According to the FDIC, average interest rates on CDs ranged from % (for one-month CDs) to % (for five-year CDs), as of January Why we picked First Internet Bank's 5-year CD. First Internet netted the top spot on our list because it had the highest APY, clocking in at a stellar %. Lafayette Federal Credit Union has the best 2-year, 3-year, 4-year, and 5-year CD rates available. These CDs also stand out because they have a $ minimum. Current 5-year CD rates · SchoolsFirst Federal Credit Union — % APY · First Internet Bank of Indiana — % APY · Synchrony Bank — % APY · Marcus by.

A CD is a savings account that holds a lump sum of money for a set period of time, such as six months, one year, or five years, in return for fixed interest. Certificates of Deposit, also known as CDs, are a smart, safe choice for saving money for the future. By putting aside money for a set period of time. Certificate of Deposit (CD) accounts usually pay you a higher interest rate than a traditional savings account. Compare CD types and rates to get started. The 1, 2, 3, 4, and 5 year CDs require a $ minimum deposit to open the account and to earn the APY. The stated interest rate is fixed for the term of the CD. Best 5-year CD rates · Telco Triad Community Credit Union (bump-up CD): % · East Texas Professional Credit Union: % · Freedom Credit Union: % · Keys. Best 3-Month CD: Merchants Bank of Indiana · Best 6-Month CD: DR Bank · Best 1-Year CD: Mountain America Credit Union · Best Month CD: Connexus Credit Union. Top Banks & Credit Unions for 5-Year CDs · Quontic: % APY · Discover® Bank: % APY · Ally Bank: % APY · Bread Financial: % APY · First Internet Bank. The best 1-year CD rate right now is % APY from Mountain America Credit Union and Merchants Bank of Indiana. If you're looking to save money for a. Certificates of deposit (CDs) can be a good choice when you want steady, predictable investment income that is federally insured A Certificate of Deposit (CD) account is a low risk, high-rate savings account option. With a fixed interest rate that is often higher than a traditional. 's Best Credit Union CD Rates – Editor's Picks ; 5-year CD, Sentry Credit Union CD, %, $ ; year CD, Credit Human CD, %, $ ; No-Penalty CD. Best 5-Year CD Account: Bread Financial. Bread Financial has a premier five-year CD account that features an incredibly strong % APY. To put this rate into. 6+ Year CD Rates ; Eastman Credit Union. 6 Year Investment Certificate. ; Via Credit Union. Month CD. ; Big Horn Federal Savings Bank. 6 Year CD. Quontic's CDs shine with top rates across terms from six months to five years, and the opening minimum of $ is relatively low compared to other online banks. As of June , the average month CD rate is %, according to data from the FDIC. While that might seem low, it's possible to find certificates with a. At maturity, 7, 10, 13, 25 and 37 Month Featured CD accounts will automatically renew into a Fixed Term CD account with the same term length unless you make. Traditional CD. 5 Year Term | $1, Minimum Opening Balance ; Month Add-on CD. $ Minimum Opening Balance | Make Additional Deposits of $50 or greater. Renew the CD at a term and rate that is best for you,; Add funds or generally make withdrawals,; Close the CD. Interest is only paid through the maturity date. » See more best 3-year CD rates ; CURRENT CD RATES: 5-year ; Popular Direct. % APY. ; BMO Alto. % APY. ; Bread Savings™. % APY*. nbkc is the KC Strongest Bank Award winner, offering Certificates of Deposit (CDs). Pick your own term with rates up to % APY. Start earning today!

Guaranteed Personal Loans For Fair Credit

This guide will help you know the options available to you and give you some insight on what to expect when looking for a personal loan with fair credit. A personal loan for bad credit is a type of loan designed for individuals with less-than-perfect credit. Personal loans for fair credit are for borrowers with credit scores from to Compare rates and terms at online lenders offering loans up to $ Collateral is usually not required and personal loans typically have lower interest rates than most credit cards. Since interest rates and loan terms on a. To qualify for a % APR loan, a borrower will need excellent credit, a loan amount less than $12,, and a term of 24 months. Adding a co-borrower with. Personal loans are accessible to those with bad credit; traditional lenders use credit scores to determine loan decisions and rates. We scrutinized dozens of lenders to find the best personal loans for fair credit. Find out where to get one and how to improve your chances. Upgrade: Best for fair credit · Discover Personal Loans: Best for no origination fees (and low rates) · Best Egg: Most likely to qualify if pre-approved. If you have a fair credit score, limited credit background, or you've hit a few bumps along the way, Reprise can help you find the personal loan that's right. This guide will help you know the options available to you and give you some insight on what to expect when looking for a personal loan with fair credit. A personal loan for bad credit is a type of loan designed for individuals with less-than-perfect credit. Personal loans for fair credit are for borrowers with credit scores from to Compare rates and terms at online lenders offering loans up to $ Collateral is usually not required and personal loans typically have lower interest rates than most credit cards. Since interest rates and loan terms on a. To qualify for a % APR loan, a borrower will need excellent credit, a loan amount less than $12,, and a term of 24 months. Adding a co-borrower with. Personal loans are accessible to those with bad credit; traditional lenders use credit scores to determine loan decisions and rates. We scrutinized dozens of lenders to find the best personal loans for fair credit. Find out where to get one and how to improve your chances. Upgrade: Best for fair credit · Discover Personal Loans: Best for no origination fees (and low rates) · Best Egg: Most likely to qualify if pre-approved. If you have a fair credit score, limited credit background, or you've hit a few bumps along the way, Reprise can help you find the personal loan that's right.

We'll share with you the best personal loans for fair credit in , as well as tips for comparing personal loans, improving your credit score, and more. Here we explore that question for fair credit consumers. However, much of this information applies to anyone looking for a personal loan. Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. Find the funds you need now — fast, easy, secure. · LendingPoint. 60 months. Term of Loan. %. Fixed APR. $ Est. Monthly Payment. Continue. Disclaimer. Best fair credit personal loans · Prosper: Best overall. · Avant: Best for building credit. · Achieve: Best for discounts. · LendingPoint: Best for quick approval. Get a loan quickly even with no credit history. Fixed, affordable payments available. Prequal won't affect your credit score. Apply now. To qualify for a % APR loan, a borrower will need excellent credit, a loan amount less than $12,, and a term of 24 months. Adding a co-borrower with. A Personal Unsecured Installment Loan provides you access to the money you need without using your property as collateral. · Pay Off Credit Cards · Moving. The best personal loans for bad credit with nearly guaranteed approval have loan amounts from $ - $+. Apply online & get the best deal. Get up to $50, for debt consolidation, home improvement, or any other major expense. See your personalized initial offer with no impact to your credit score. Best for people without a credit history: Upstart Personal Loans · Best for debt consolidation: Happy Money · Best for flexible terms: OneMain Financial Personal. US Bank topped our list primarily because of its affordability. The lender doesn't charge origination fees, which can cost up to 12% of the loan amount. But LoanNow may be the best possible choice for personal loans for fair credit. Banks and Credit Unions Will Need Collateral or Cosigner. Personal Loans for. Atlas Credit is excellent for fair credit score loan options and has team members you can contact to answer your questions throughout the process. You have. Get the funds you need fast by exploring the best bad credit loans from top lenders like Discover, Upstart, & SoFi. Find your lowest rate & apply online! Discover has the best personal loans for people with fair credit, offering loan amounts up to $40, with no origination fee, an APR range of % - %. GreendayOnline is a well-established online lender that specializes in providing personal loans to individuals with fair credit. They offer. We understand a low credit score can make it difficult to get an affordable loan so we don't base our funding decisions exclusively on FICO® credit scores or. Best for Large Amounts: SoFi. SoFi logo. · Good - Exceptional · - % · 24 - 84 mo ; Best for Debt Consolidation: Happy Money. Happy Money logo. · Fair -. If we look solely at credit score, you may qualify with a If you find yourself needing extra money, a personal loan could be the right option for you.

Bit Coin Green

What is green cryptocurrency? Green cryptocurrencies are digital currencies that prioritize energy efficiency, often with the aim of carbon neutrality. These. Bitcoin's potential to replace multiple industries and reduce overall carbon emissions cannot be ignored. With its decentralized nature and reliance on. Launched in to provide an energy-efficient alternative to Bitcoin and proof of work consensus, BitGreen utilizes its proprietary protocol and. BITG is a project that will not give up, it has supported green projects and continuously does so. While BITCOIN has been burning trees BITG has literally been. Chief of Staff at BTC Inc · Experience: BTC Inc · Education: The University of Alabama · Location: Nashville Metropolitan Area · + connections on. Blockstream Green is not a platform for buying and selling bitcoin. Blockstream Green is a Bitcoin wallet, which is a way for you to. Blockstream Green is a simple and secure Bitcoin wallet that makes it easy to get started sending and receiving Bitcoin and Liquid-based assets such as. PayPal's Blockchain Research Group's partner EnergyWeb has developed a clean energy validation platform to permit Bitcoin miners to obtain low-. The price of Green Bitcoin (GBTC) is $ today with a hour trading volume of $52, This represents a % price decline in the last 24 hours and. What is green cryptocurrency? Green cryptocurrencies are digital currencies that prioritize energy efficiency, often with the aim of carbon neutrality. These. Bitcoin's potential to replace multiple industries and reduce overall carbon emissions cannot be ignored. With its decentralized nature and reliance on. Launched in to provide an energy-efficient alternative to Bitcoin and proof of work consensus, BitGreen utilizes its proprietary protocol and. BITG is a project that will not give up, it has supported green projects and continuously does so. While BITCOIN has been burning trees BITG has literally been. Chief of Staff at BTC Inc · Experience: BTC Inc · Education: The University of Alabama · Location: Nashville Metropolitan Area · + connections on. Blockstream Green is not a platform for buying and selling bitcoin. Blockstream Green is a Bitcoin wallet, which is a way for you to. Blockstream Green is a simple and secure Bitcoin wallet that makes it easy to get started sending and receiving Bitcoin and Liquid-based assets such as. PayPal's Blockchain Research Group's partner EnergyWeb has developed a clean energy validation platform to permit Bitcoin miners to obtain low-. The price of Green Bitcoin (GBTC) is $ today with a hour trading volume of $52, This represents a % price decline in the last 24 hours and.

Bitcoin Green USD Price Today - discover how much 1 BITG is worth in USD with converter, price chart, market cap, trade volume, historical data and more. A green cryptocurrency must maintain the integrity of the blockchain while being energy efficient and minimising the carbon footprint. This work introduces a strategy by synergizing green hydrogen technologies with bitcoin mining operations to address the concurrent challenges of. Block Green is a liquidity platform offering new financial solutions that benefit the whole data center industry. Bitcoin miners, HPC, and all datacenters. Bitcoin Green is on the rise this week. The price of Bitcoin Green has increased by % in the last hour and increased by % in the past 24 hours. r/btcgreen: Bitcoin Green: The Sustainable, Proof-of-Stake Bitcoin. The Global Green Energy for Bitcoin Market is expected to be worth around USD Billion by , with substantial growth from USD Billion in , at. Find the latest Bitcoin Green USD (BITG-USD) stock quote, history, news and other vital information to help you with your stock trading and investing. The Green Protocol offers a simple solution to Bitcoin sustainability issues and provides a faster, more scalable blockchain that is better suited for daily. Blockstream Green is an open source, multi-platform Bitcoin wallet. Download now for iOS, Android or Desktop. Green Bitcoin is a gamified staking platform that allows participants to earn rewards by predicting Bitcoin price action. Based on market trends and the anticipated growth in eco-friendly cryptos, Green Bitcoin could reach around $2 by the end of Bitcoin Green Info. Ad. Bitcoin Green (BITG) is founded on 'The Green Protocol,' which utilizes a highly efficient proof-of-stake consensus algorithm that. View the Green Bitcoin (GBTC) price live in US dollar (USD). Today's value and price history. Discover info about market cap, trading volume and supply. It's important to note that current Bitcoin Green market capitalization is $0, and the maximum supply is 21,, BITG coins. Talking about circulating supply. Green Bitcoin price today is $ with a hour trading volume of $18, GBTC price is down % in the last 24 hours. It has a circulating supply of. Mobile 1. On the home screen of your Blockstream Green wallet, tap Send. 2. Paste the address of the recipient in the corresponding. - The live price of Bitcoin Green is -- per (BITG/USD). View Bitcoin Green live charts, BITG market information, and BITG news. Track current Bitcoin Green prices in real-time with historical BITG USD charts, liquidity, and volume. Get top exchanges, markets, and more.

Cheapest Investment Loans

Compare Investor Loan Interest Rates from % ; IMB Bank. IMB Bank Budget Investment Loan (Principal and Interest) (LVR. Mozo's expert guides and handy calculators can help you compare investment loan rates, including interest-only and low-rate mortgage deals. Compare current investment property mortgage rates using the free, customized rate shopping tool from NerdWallet. Compare Florida mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Compare loan. A low cost home loan for investors who are looking for a low variable interest rate without the extra features. No mortgage offset available. Minimum $, Investment property loans; Condominium loans; Land loans; Double and single-wide mobile home loans; Government and affordable housing programs; Insurance and. Our affordable lending options, including FHA loans and VA loans, help make homeownership possible. Check out our affordability calculator, and look for. Hard money investment property loan interest rates are typically higher than interest rates available from a conventional lender (if the conventional lender is. Thinking about buying a rental property to diversify your income streams? Learn how to apply for a loan and compare investment property mortgage rates. Compare Investor Loan Interest Rates from % ; IMB Bank. IMB Bank Budget Investment Loan (Principal and Interest) (LVR. Mozo's expert guides and handy calculators can help you compare investment loan rates, including interest-only and low-rate mortgage deals. Compare current investment property mortgage rates using the free, customized rate shopping tool from NerdWallet. Compare Florida mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Compare loan. A low cost home loan for investors who are looking for a low variable interest rate without the extra features. No mortgage offset available. Minimum $, Investment property loans; Condominium loans; Land loans; Double and single-wide mobile home loans; Government and affordable housing programs; Insurance and. Our affordable lending options, including FHA loans and VA loans, help make homeownership possible. Check out our affordability calculator, and look for. Hard money investment property loan interest rates are typically higher than interest rates available from a conventional lender (if the conventional lender is. Thinking about buying a rental property to diversify your income streams? Learn how to apply for a loan and compare investment property mortgage rates.

Lowest variable investor rate: % p.a. (2-year intro rate), comparison rate % p.a. (max 95% LVR). Orange Credit Union. Lowest 1-year fixed rate: %. As per our home loan comparison tool above, the lowest current interest rate as of the 9th of January for an investment loan is % p.a* with a. Jumbo LoansCollapse Opens DialogCollapse · Year Fixed-Rate Jumbo · Interest% · APR%. Variable investor loan rates · Easy Street Street Smart Variable Home Loan | % p.a. (% p.a. comparison rate*) · Gateway Bank Green Plus Home Loan | %. Purchase or refinance a residential investment property anywhere in the USA. Investment property loans up to $ million. Reduce Home Loans - the most awarded non-bank lender for having the cheapest home loan in Australia. Call us on Discover other affordable home loan options · FHA Mortgage. % minimum down payment; No income limits · VA Mortgage. No down payment required; No income limits. Compare mortgage rates when you buy a home or refinance your loan. Save loans for investment and multifamily properties. Home renovation loans are. Reduce Home Loans - the most awarded non-bank lender for having the cheapest home loan in Australia. Call us on Learn how our Affordable Loan Solution® mortgage with a down payment as low Mortgage Rates & Loans. Mortgage Overview · Mortgage Rates · Fixed-rate. Compare investor loan interest rates from %. Find the cheapest rates for investment home loans available in the market today. Bring these lenders deals that cash flow well, and they'll offer you a warmer reception. If you do use a conventional mortgage loan, lenders typically allow a. Your prequalification · Our home loans — and low home loan rates — are designed to meet your specific home financing needs · Today's competitive mortgage rates. Rates listed on Canstar's home loans database show that, on average, the interest rates for investment loans will tend to be higher than those charged on owner-. Hot investment home loan rates in August · Australian Mutual Bank: GumLeaf Standard Variable Investment P&I (LVR. monitoring-obmennikov-ru.site Solar Investment Loan - LVR ≤90%. P&I. %. % ; Beyond Bank. Purple Basic Variable Rate Investment Loan (limited time offer) - LVR ≤60%. P&I. Our low fixed rate and adjustable rate home loans offer low monthly payments and low down payments. Find the loan, refinance or home equity option that best. Loans Business Financing Business Loans Business Lines of Credit. Invest Not all applicants will qualify for the lowest rate. ↵. Rates · Loan Rates. For your first few deals, you can probably get away with a conventional mortgage loan, at low-ish interest rates. But conventional lenders don't like seeing. A DSCR loan is suited to real estate investors who have a complicated financial situation but have good property deals that they need investment property loans.

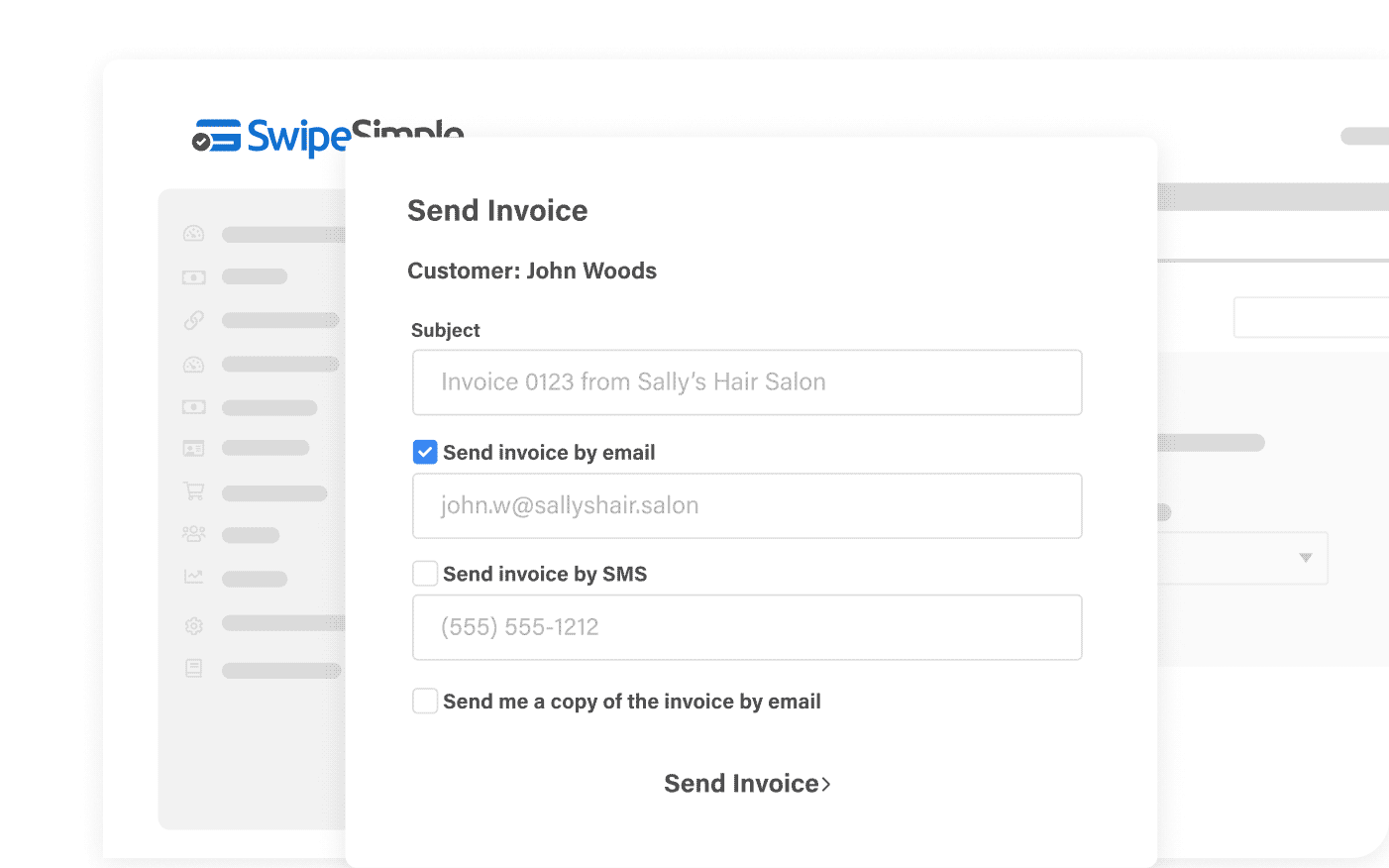

Swipe Simple Pricing

SwipeSimple is the best way for small businesses to accept credit cards when running a business. Every SwipeSimple account comes with powerful tools and. The SwipeSimple Mobile App gives you everything you need to swipe, dip, or Pricing · Technology · About · Reviews · Blog · Login. VizyPay LLC is a registered. Merchants sign up for SwipeSimple in two ways: Pricing and fees assessed for SwipeSimple will come from the company through which you initially signed up for. Only pay when you take a payment. Pay % + 10¢ per swipe, dip, or tap or % + 15¢ per manually entered transaction. We can create custom pricing. Swipe (traditional magnetic card); Dip (EMV chip card); Tap (Contactless card Pricing Plans0% Processing. Contact. EnrollmentContact UsNeed Help. Payment seamlessly integrates with Stripe's Product system, allowing you to setup as many products and price points as you'd like which can be sold both online. SwipeSimple B Accept EMV Quick Chip, magnetic stripe, and contactless tap-to-pay Bluetooth Low Energy connection Long-lasting battery life. SwipeSimple is the best way for small businesses to accept payments anywhere, on the go, in their store, and at their computer. Only $ per month plus a flat rate of % of the total payment and $ per transaction. Schedule A Conversation. SwipeSimple is the best way for small businesses to accept credit cards when running a business. Every SwipeSimple account comes with powerful tools and. The SwipeSimple Mobile App gives you everything you need to swipe, dip, or Pricing · Technology · About · Reviews · Blog · Login. VizyPay LLC is a registered. Merchants sign up for SwipeSimple in two ways: Pricing and fees assessed for SwipeSimple will come from the company through which you initially signed up for. Only pay when you take a payment. Pay % + 10¢ per swipe, dip, or tap or % + 15¢ per manually entered transaction. We can create custom pricing. Swipe (traditional magnetic card); Dip (EMV chip card); Tap (Contactless card Pricing Plans0% Processing. Contact. EnrollmentContact UsNeed Help. Payment seamlessly integrates with Stripe's Product system, allowing you to setup as many products and price points as you'd like which can be sold both online. SwipeSimple B Accept EMV Quick Chip, magnetic stripe, and contactless tap-to-pay Bluetooth Low Energy connection Long-lasting battery life. SwipeSimple is the best way for small businesses to accept payments anywhere, on the go, in their store, and at their computer. Only $ per month plus a flat rate of % of the total payment and $ per transaction. Schedule A Conversation.

Monthly Fee: $19 · Card Swipe / Dip: % + $ · Keyed in / Online: % + $ · (Compare % + $ with Square). Take the work out of taking payments. Accept credit cards and print receipts with SwipeSimple Terminal, a safe and convenient all-in-one device. You need our highly ranked "EMSmobile" solution. Mobile Credit Card Processor for Business. swipe simple Mobile Payment Processing. dots background pattern. Swipe Right is More Than Alright With Me! I work for an Attorney and have processed many credit cards! This is the easiest system I have used in some 10+. Easy-to-use payment solutions for small businesses. · Everything you need to accept payments wherever your business takes you. · SwipeSimple Register 8. Pricing. Dual Pricing- Your customers cover the fees. You pay monitoring-obmennikov-ru.sitet sold out or unavailable. Traditional Pricing- Starting at 1%+$ per transaction. SwipeSimple. Payment solutions for small businesses. monitoring-obmennikov-ru.site pricing information for this product or service. Conclusion. We could not. At Stax, our subscription-based pricing can save businesses up to 40% in payment processing and starts at just $99 per month. We do not markup interchange fees. Download the Swipe Simple user guide here. Connecting the B and B to your mobile device. Download and install the SwipeSimple app. The app can be. Accept credit card payments anywhere with a SwipeSimple card reader and your own iOS or Android phone or tablet. Simple pricing as low as % and 10¢ per transaction. Fill out the form on this page. Apply and get approved. Start taking payments anywhere. SwipeSimple is a "simple" solution for allowing people to donate to our agency via credit card. Our bank highly recommended it because of its security. Review. Accept credit card payments on the go - SwipeSimple gives you the tools to take credit card payments anytime, anywhere. HOW IT WORKS: 1. Simple to setup and easy to use. PAX A80 without monthly Platform Fee. $ Billing. SwipeSimple Account (Fee is per Terminal or Mobile license. Merchants. SwipeSimple user reviews from verified software and service customers. Explore ratings, reviews, pricing, features, and integrations offered by the Payment. SwipeSimple Connect pricing is simple. . You only pay for SwipeSimple To be able to tap, dip, or swipe a card, you can also purchase a: . Bluetooth. Explore SwipeSimple pricing, reviews, features and compare other top Payment Processing Software to SwipeSimple on monitoring-obmennikov-ru.site PLEASE NOTE, THIS PRICE IS ONLY FOR CUSTOMERS OF SECURE PAY SERVICE'S CREDIT CARD PROCESSING. IF YOU ARE NOT A CUSTOMER, AND YOU WANT THIS SPECIAL PRICING. With the help of Capterra, learn about SwipeSimple - features, pricing plans, popular comparisons to other Payment Processing products and more. The SwipeSimple Mobile App gives you everything you need to swipe, dip, or Pricing · Technology · About · Reviews · Blog · Login. VizyPay LLC is a registered.

1 2 3 4 5